Harness the Collective Goodwill of Your Workforce

Employee Workplace Giving

Enable employees to conveniently make tax-deductible donations that fuel nonprofit impact through sustainable support.

Benefits

Workplace giving (also referred to as “employee giving” or “payroll giving”) is one of America’s oldest and most generous employee involvement programs, raising an estimated $5 billion for U.S. charities each year. Sponsored by employers, workplace giving empowers employees to make tax-deductible charitable donations to support their favorite nonprofit organizations, traditionally through recurring payroll deduction pledges. That is a simple explanation, but the creation and execution of such a program can take many different forms.

The donation methods, campaign structure, and technology involved in workplace giving have changed substantially since America’s Charities first started facilitating employee giving campaigns in 1980, but the value workplace giving brings to nonprofits, employers, and employees remains the same – and just as important as ever.

Accessible to All Employees

While it’s not uncommon to see credit card, ACH, and other payment methods offered in addition to payroll deduction, payroll deduction is the preferred workplace giving payment method because everyone receives a paycheck, which ensures everyone in your company has the opportunity to participate in your program. Payroll deduction is also the easiest donation method for employees since they don’t have to link any bank accounts or enter credit card information – they just sign into your giving site, decide how much they want to give to which charities, and submit!

Unrestricted Money for Nonprofits

Workplace giving contributions give charities a sustainable, year-round source of funds. And because this money is often unrestricted (not earmarked for a specific program or purpose), your employees’ donations provide charities with funds that enable them to decide how to best use that money and invest in their ability to deliver vital programs and services. And because charities know how much money they can expect to receive from workplace giving donations, they can plan how to use those contributions more strategically and make a stronger impact.

Amplify Impact & Increase Participation

Some employers will offer to match employee contributions up to a specified amount. This gives employees a huge incentive to give – and gives employers an opportunity to supercharge the impact of their workplace giving program. Matching gifts is one of the top five motivations for workplace donors. In fact, 84% of donors say they're more likely to donate if a match is offered.

Financially More Manageable

Many workplace giving programs give employees the option of pledging different amounts of money to different charities. This gives employees the chance to spread their giving across several different organizations committed to causes they care about. By having a smaller amount of money deducted from your paycheck throughout the year via recurring payroll deduction, employees can donate a larger amount of money and have a greater impact overall without feeling the pinch all at once. For example, if you get paid biweekly (26 times throughout the year) and you pledge $38.50 of each paycheck to a charity, by the end of the year you will have donated $1,000 to that charity!

Cost-efficient Fundraising for Nonprofits

Fundraising from individual donors and foundations is a major challenge for many nonprofits – and it requires a substantial investment in staff time and marketing. When your company sets up a workplace giving program, you’re giving charities an efficient and effective fundraising vehicle. This means that employee donations enable charities to spend more time and resources on services and programs that support their mission, rather than elaborate, resource-intensive fundraising efforts.

Convenience & Tax Benefits

Employees can get the convenience of automatic, recurring payroll deductions without losing the tax benefits of charitable giving. Employees can easily support the same charities each year or add new charities to support each year as they discover new causes to support.

Why Partner With America's Charities?

You only have one chance to make a first impression. That’s especially true when you introduce your workplace giving program to employees for the first time. It’s critical that the rollout of a workplace giving program is seamless as possible – both from an operational standpoint as well as effectively promoting the program to gain maximum engagement on day one. With America's Charities as your partner, we'll be at your side from implementation and launch to providing ongoing support and insight to assure continued success year after year.

If done right, workplace giving, offers a rare opportunity in which everyone wins. A thriving program will help attract top talent, and keep them engaged once they are part of the team. It will bolster your company’s reputation – and its bottom line. And, most importantly, it will make your organization a force for good in your community, providing a cost-effective and steady stream of funding for charities to fulfill their missions and make a real difference in countless lives.

Multiple Donation Payment Methods Supported

While we are strong advocates of payroll deduction giving, we understand the importance of offering donation methods that appeal across multiple generations. We can facilitate multiple payment methods including one-time or recurring payroll deduction, credit/debit card, ACH, checks, and stock donations.

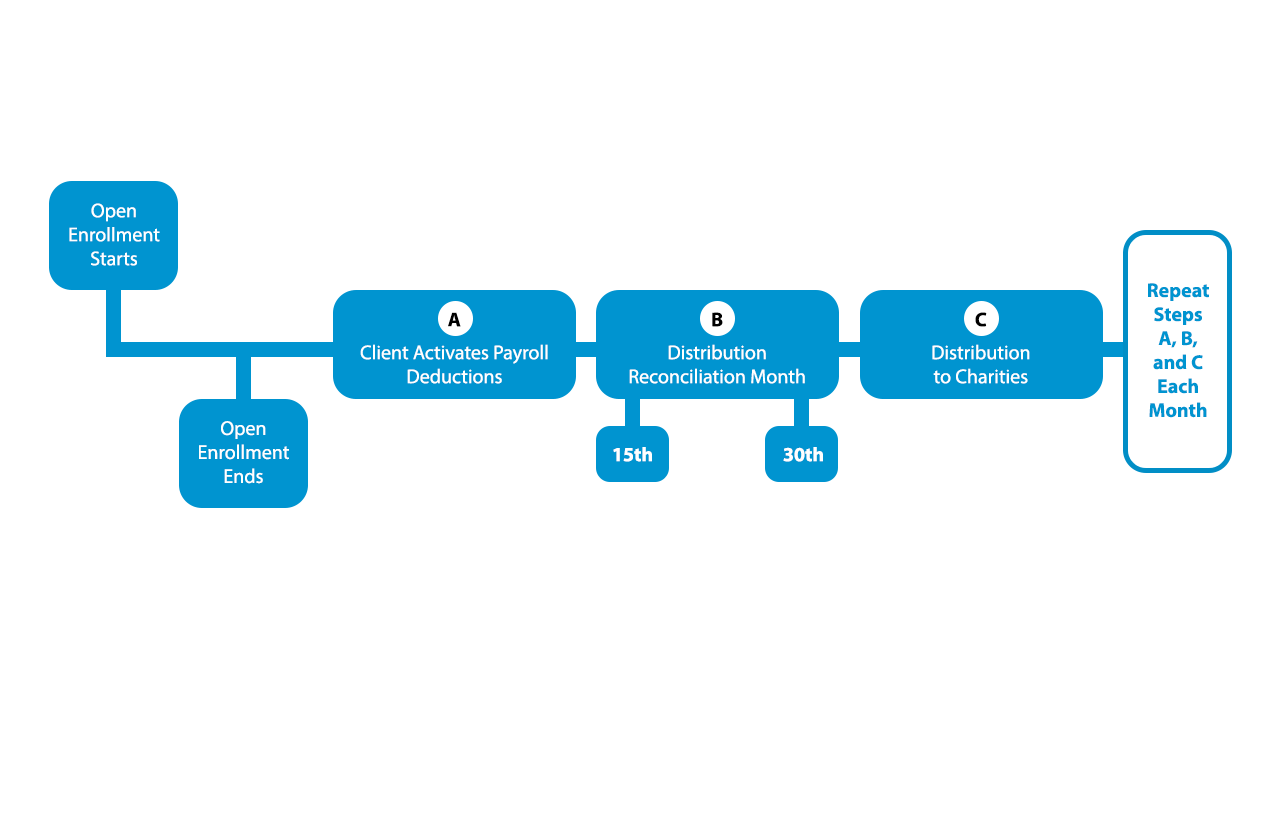

Aggregated Distribution

By aggregating and distributing all funds to charities on your behalf, including employee donations and any company matching gifts you might offer, nonprofits receive funds more efficiently – even more so if the nonprofit has opted in to receive funds via Electronic Funds Transfer (EFT) instead of by check. Plus, since America’s Charities is a 501(c)(3) nonprofit organization, we handle the distributions for you (we don’t have to outsource that task to a third party foundation).

Flexibility with your Payroll System and Schedule

Eliminate the administrative burden required to successfully implement your workplace giving program. Whether your company uses Workday, ADP or other payroll management systems, and regardless of what frequency employees get paid (or if that frequency varies by employee), we help automate payroll deduction donations and make the payroll giving process easy for employees and more streamlined for your payroll and HR teams.

Consolidated Annual Tax Receipts

In addition to the donation record and receipts donors receive upon making a contribution, a consolidated annual tax receipt is provided to donors after the tax year concludes to help employees provide necessary documentation for tax filing purposes.

Solutions And Partnership Highlights

More than 40 Years of Experience

Receiving, reconciling and distributing employee-designated donations has been a core competency since our inception. Each year, we process over 1 million transactions and send approximately 50,000 grants and payments to qualified nonprofits. With 200 private and public sector partners whose workplace giving programs, matching gift campaigns, employee assistance funds, and volunteer initiatives we manage and distribute funds for, we have a lot of experience and first-hand knowledge to share with your team to help you implement your program.

Accurate and Timely Funds Distribution

By bundling donations into one payment for each designated nonprofit, your charity partners can focus more of their time and resources on making an impact with your support. To ensure accurate and timely disbursement of donations to designated charities we:

- Reconcile funds received against donor designations based on partner-provided data,

- Disburse funds to donor-designated charities each month,

- Do not require a minimum amount to be reached before a disbursement is made, nor does America’s Charities charge any extra fees for paper checks, and

- Manage returned checks/payments from charities by conducting additional research to verify proper address and contact information of the designated charity, and then reissue payment.

Extensive Reporting & Help Desk Support

For partners’ strategic purposes and for donors’ peace of mind we:

- Provide multi-channel support to assist donors with questions about their donations,

- Contact donors about re-designating their gift if their original designated charity is no longer qualified to receive donations,

- Ensure all charities receiving donations are qualified and in good standing with the IRS at the time of distribution and not on the Office of Foreign Assets Control (OFAC) list,

- Give charities access to reports and Help Desk support regarding the disbursements made from donors,

- Provide clients with prebuilt reports, as well as custom reports, and

- Provide partners with status updates and reports of donation disbursements.