Multiply Employee Engagement and Social Impact

Matching Gifts

Unite your team and amplify your impact in the community by financially matching employee contributions.

Benefits

Matching gift programs are set up by companies that want to promote social good and encourage their employees to give. For every dollar (or other specified amount) an employee gives to charity, the company agrees to give a corresponding donation to that same charity. Companies can choose to set up matching gift programs in a number of ways based on their culture and capacity. But, at their core, matching gift programs are structured around the idea that, together, companies and their employees can have a greater impact if they leverage their resources together.

Increasingly, employees choose where to work based on whether their employers share their values. 71% of employees say it is important to work where the culture is supportive of giving and volunteering, and nearly 3 in 5 employee donors say it is imperative or very important that the company they work for match personal donations with corporate funds. Offering matching gifts provides employers an effective way to burnish their charitable reputations while helping attract and retain talent – not to mention bringing even more critical resources nonprofits rely on to improve the lives of the people they serve.

Increase Participation in Your Giving Campaign

Matching gifts is one of the top five motivations for workplace donors. In fact, 84% of donors say they're more likely to donate if a match is offered.

Incentivize Greater Giving

1 in 3 employees say they would give a larger gift if matching is applied to their donation.

Provide Nonprofits an Important Source of Funds

With 65% of Fortune 500 companies and many smaller companies offering matching gift programs, they represent an important source of funding for nonprofits.

Why Partner With America's Charities?

Our team can share insights and examples of matching gift policy structures and rules that work well, build workflows to automate and support your unique review and approval process, provide communication templates and infrastructure for promoting your matching gift campaign to employees, process and distribute matching gifts, and arm you with the dashboards and reports you need for monitoring your matching gift budget and sharing results with key stakeholders.

Configurable Matching Attributes

Your company’s unique matching gift criteria is configured to enforce attributes such as minimum/maximum donation amounts, individual match caps, start and end dates the match is available, and which charities are eligible.

Automated Approval Process

Workflows can be established to support pre-defined triggers to validate approvals for matching gifts awarded. When matching dollar limits are reached, the system will disallow further matching for the designated timeframe, however users can continue making personal contributions if you wish.

External, Offline Match Requests Supported

An online form may be enabled for users to request a match for donations or volunteer time contributed outside of the giving platform. Requests can be configured to go through a client approval process or be automatically approved – you choose. Additionally, the form can require donors to upload documentation proving their offline donation.

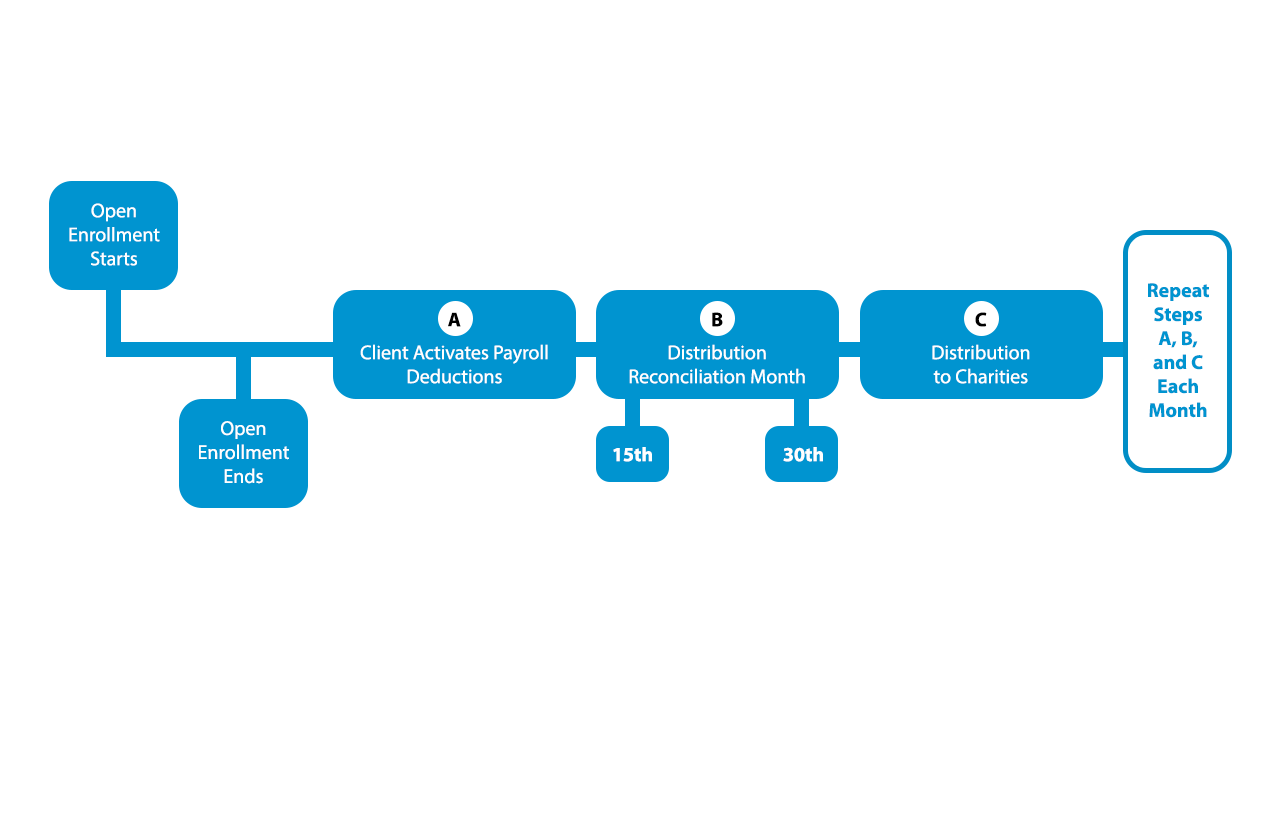

Careful Reconciliation and Streamlined Invoicing

Each distribution cycle (monthly or quarterly depending on the company), after confirming all employee donations and their designated charities are match-eligible, your team provides the corresponding matching funds to be distributed (you can wait to be invoiced or pre-fund an account for expedited distribution). Each distribution is accompanied by a remittance email or letter with unique login credentials for the recipient charities to access reports so they can build relationships and share impact with donors who opt-in to be acknowledged, as well as recognize your company’s support (if you choose to have your company name shared with the nonprofit).

Aggregated Distribution

By aggregating and distributing all funds to charities on your behalf, including employee donations and the company matching gifts together, nonprofits receive funds more efficiently – even more so if the nonprofit has opted in to receive funds via Electronic Funds Transfer (EFT) instead of by check. Plus, since America’s Charities is a 501(c)(3) nonprofit organization, we handle the distributions for you (we don’t have to outsource that task to a third party foundation).

Ability to Feature Your Community Partners and Engage Employees Around Charitable Causes

In addition to democratizing matching gifts by letting employees designate their favorite charities to receive your company’s match, we provide a pre-built framework for you to feature your nonprofit partners to encourage employees to support your corporate causes and goals. Additionally, we offer ready-to-use cause articles and content featuring America’s Charities vetted charity members, providing your team with fresh content to engage employees with each month.

Solutions And Partnership Highlights

More than 40 Years of Experience

Receiving, reconciling and distributing employee-designated donations and managing corporate matching funds has been a core competency since our inception. Each year, we process over 1 million transactions and send approximately 50,000 grants and payments to qualified nonprofits. With 200 private and public sector partners whose workplace giving programs, matching gift campaigns, employee assistance funds, and volunteer initiatives we manage and distribute funds for, we have a lot of experience and first-hand knowledge to share with your team to help you implement your programs and policies successfully in a way that makes sense for your team’s unique needs.

Accurate and Timely Funds Distribution

By bundling donations into one payment for each designated nonprofit, your charity partners can focus more of their time and resources on making an impact with your support. To ensure accurate and timely disbursement of donations to designated charities we:

- Reconcile funds received against donor designations based on partner-provided data,

- Disburse funds to donor-designated charities each month,

- Do not require a minimum amount to be reached before a disbursement is made, nor does America’s Charities charge any extra fees for paper checks, and

- Manage returned checks/payments from charities by conducting additional research to verify proper address and contact information of the designated charity, and then reissue payment.

Extensive Reporting & Help Desk Support

For partners’ strategic purposes and for donors’ peace of mind we:

- Provide multi-channel support to assist donors with questions about their donations or how to request a match,

- Contact donors about re-designating their gift if their original designated charity is no longer qualified to receive donations,

- Ensure all charities receiving donations and the company’s corresponding match gift are qualified and in good standing with the IRS at the time of distribution and not on the Office of Foreign Assets Control (OFAC) list,

- Give charities access to reports and Help Desk support regarding the disbursements made from donors, and

- Provide partners with status updates and reports of donation disbursements.