Supporting Employees In Times Of Hardship

Employee Relief And Emergency Assistance Funds

When the unexpected happens – a large-scale disaster or a personal hardship – you can support your workforce financially with a tax-advantaged Emergency Assistance Fund (EAF), also known as an Employee Relief Fund or an Employee Crisis Fund.

Benefits

No matter the scale or severity of the crisis, employee financial stress hurts companies and their employees. A Federal Reserve study found that employee financial stress costs employers an average of $5,000 per employee, per year, in lost productivity. Serving as a mechanism for employers to focus their corporate social responsibility (CSR) efforts inward on employee needs and wellness, many companies establish these funds to:

Demonstrate true compassion and caring for employees

Assist employees with financial setbacks such as a medical problems that causes family members to stop working, funeral expenses, an emergency that necessitates travel, or help establishing or re-establish a habitable and safe residence following hurricane, fire, flood, tornado, etc.

Increase productivity, employee engagement and retention

Retention skyrockets when employers show workers they care. The Limeade Institute reported that 60% of workers who felt cared for planned to stay for the next three years; 94% felt engaged.

Protect employee privacy and maintain confidentiality

Companies can unobtrusively help employees recover more quickly while employee information remains confidential.

Empower the workforce to come together

Co-workers are provided an opportunity to help their colleagues and build an internal culture.

Easily integrate with a giving and engagement program

Companies can fund an EAF in a variety of ways including setting aside a budget or empowering their employees to donate to the EAF through its workplace giving program. If you don’t have an existing program, your EAF can be the cornerstone for your new CSR or wellness program.

Support employees where they are

Your EAF program can support your employees wherever they may be - in your office or at home, in-person or remote, located in the US or internationally.

Why Partner With America's Charities?

Outsourcing your company’s EAF to America’s Charities offers special legal and tax advantages and supports your company’s needs in order to offer EAFs to employees in times of distress and hardship.

Mitigates Risk

Outsourcing management of the sensitive application review and appeals process to America’s Charities minimizes company’s risk and legal ramifications.

Reduces Overhead and Administrative Burden

America’s Charities provides consistent, objective application review, conducts necessary follow up, approves grants, and answers associate questions, allowing HR teams to focus on program promotion and utilization, rather than administration.

More Flexibility and Tax Advantages

With America’s Charities’ 501(c)(3) status, grants are all tax free for all instances, and working through a public charity reduces the amount of restrictions, providing additional flexibility to defined disaster and emergency hardship categories to be covered

Confidentiality

Provides anonymity, protecting employees’ privacy and reducing their reluctance to apply.

Uniformity

With America’s Charities serving as point of contact throughout entire application process, employees know who to ask questions to and can depend on knowledgeable response and timely grant determination.

Easier Management

With more disaster and emergency hardship situations covered, more employees will meet eligibility criteria necessary for assistance.

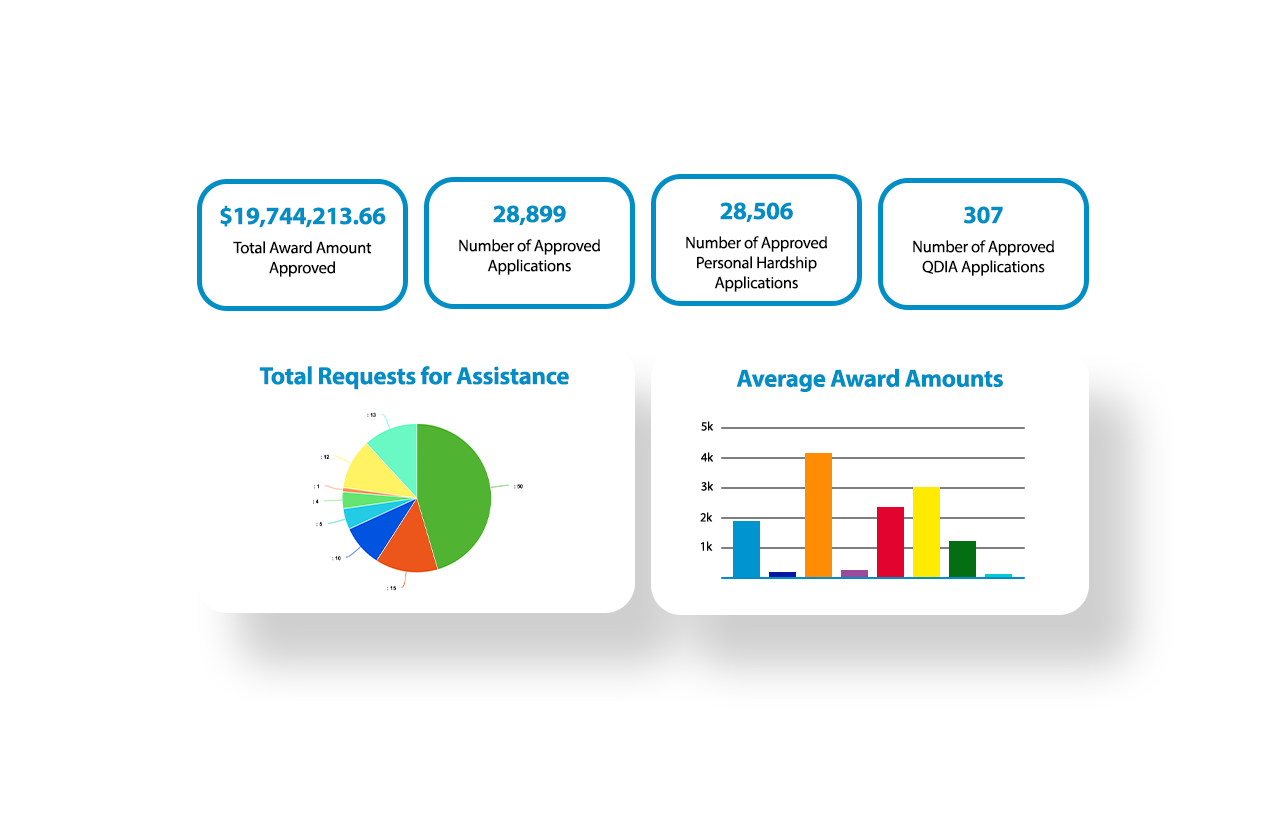

Solutions And Partnership Highlights

Easy To Setup. Custom-Designed Program

With an already-established infrastructure, America’s Charities can quickly launch and mobilize your company’s EAF, allowing your company to get started and scale faster. We can distribute assistance funds within the US and internationally.

- Whether your company needs to develop an EAF program and policies from scratch or needs to outsource an existing EAF program, America’s Charities can provide a wide range of services, including:

- Complete program design and development

- Application review and follow-up

- Grant approval

- Distribution of assistance funds within the US and internationally

- Regular reporting of fund activity

- On-demand employee support

- Overall program facilitation

- Easy integration into a workplace giving, employee engagement, or wellness program

Tax Advantages, Privacy, and Flexibility

- Because America’s Charities is a 501(c)(3) tax-exempt public charity, choosing us as your partner offers your company legal and tax benefits you would not receive if a for-profit entity or in-house team administered your fund.

- Each contribution to the EAF is tax-deductible, and all grants made from the EAF are tax-free.

- Working with America’s Charities helps your company maintain employees’ privacy and confidentiality, as well as increase participation, as workers may be less inclined to unveil personal financial hardships to their employers than they would a faceless third party.

- From designing and reviewing applications to making grant decisions and disbursing funds, handling the appeals process, and more, America’s Charities increases the flexibility of what hardships your company’s fund can cover and lowers the administrative burden to your company and the employee.

- America’s Charities stays ahead of rules and regulations so you don’t have to.

Established Experience

- There are a few different ways to set up an EAF. America’s Charities’ decades of experience in corporate relationships, customer service, and funds management ensures that your EAF is managed professionally, and we can help you determine the best way to establish your program.

- We have the capacity and expertise to support your workforce based domestically or internationally.

- Our EAF clients range from very large organizations -- including one of the world’s largest private research universities and a leading global healthcare solutions company; to mid-size -- including a financial institution and a shared business service; to smaller organizations -- including an energy storage company and a microbrewery.

- America’s Charities understands the ever-changing rules and regulations companies face with its EAF.